Also known as a carbon offset, a carbon credit is a green finance instrument that represents a reduction or removal of one metric ton of carbon dioxide equivalent (CO2e) emissions from the atmosphere.

Carbon Credits

How does a carbon credit work?

The credits themselves are typically created by initiatives which mitigate emissions, or sequester carbon, including reforestation, habitat enhancement or creation.

Third party-auditors play a crucial role in verifying the amount of carbon removed by a given initiative, in order for credit units to be priced accurately and to demonstrate verified additionality (ie. The carbon would not have been removed or mitigated without the initiative). In other words, the project goes beyond what would normally happen and results in extra emissions reductions.

Crucially, carbon credits can also be a carbon dioxide equivalent. For example, a project that reduces methane emissions may generate carbon credits, and these are calculated as equivalent to one metric ton of carbon dioxide.Entities calculate their carbon emissions, implement emission reduction or mitigation measures, and then purchase carbon credits to offset any outstanding emissions, resulting in a net-zero footprint.

The carbon market is where vendors and buyers trade and purchase credits. Some authorities have introduced carbon pricing mechanisms like taxes or cap-and-trade systems, where companies are required to purchase carbon credits or allowances to comply with emissions reduction targets.

The Voluntary Carbon Market

The voluntary carbon market plays a vital role in promoting emissions reductions, encouraging sustainable practices, and supporting climate action beyond regulatory requirements.

However, it’s important for buyers to carefully select offsets from reputable projects that adhere to established standards to ensure the effectiveness and credibility of their emissions reduction efforts. Additionally, some governments are exploring ways to regulate and standardise the voluntary carbon market to enhance its transparency and impact.

Participation in the VCM is driven by organisations and individuals who want to take proactive steps to reduce their carbon emissions and support carbon reduction projects. Companies, in particular, use voluntary offsets to demonstrate their commitment to sustainability and corporate social responsibility.

The VCM includes a wide range of project types, including renewable energy, forestry, agriculture, and waste management. These projects aim to reduce emissions, enhance carbon sequestration, and promote sustainable practices.

Buyers in the VCM can include corporations, government agencies, non-governmental organisations (NGOs), and individuals. They use carbon offsets to compensate for emissions that cannot be easily reduced through other means.

There are various online platforms and brokers that facilitate the buying and selling of carbon offsets in the voluntary market. These platforms connect buyers with projects and provide a marketplace for trading offsets. Carbon offset prices in the VCM can vary widely based on factors such as project type, quality, geographic location, and market demand. Prices may fluctuate over time.

Can I sell my carbon credits?

There are a number of initiatives based on the sale of carbon credits in the UK such as renewable energy projects like wind farms and solar installations, which generate carbon credits through the reduction of greenhouse gas emissions. These projects may sell their carbon credits to international buyers or use them for domestic compliance or voluntary carbon offset purposes.

Afforestation (planting trees on previously non-forested land) and reforestation projects in the UK contribute to carbon sequestration, resulting in carbon credits. The Woodland Carbon Code, a UK-based standard, supports the creation and sale of these carbon credits by certifying such projects.

Peatland restoration projects in the UK, aimed at improving carbon sequestration and biodiversity, may generate carbon credits. These credits can be sold to buyers looking to offset their emissions.

Companies and organisations in the UK have implemented energy efficiency measures and emissions reduction initiatives. They may sell carbon credits representing their emissions reductions on the carbon market, making business a key player in the carbon market.

Some UK-based companies and organisations have initiated voluntary offset programs, where they purchase carbon credits from various projects to compensate for their own emissions. These programs often include both domestic and international projects.

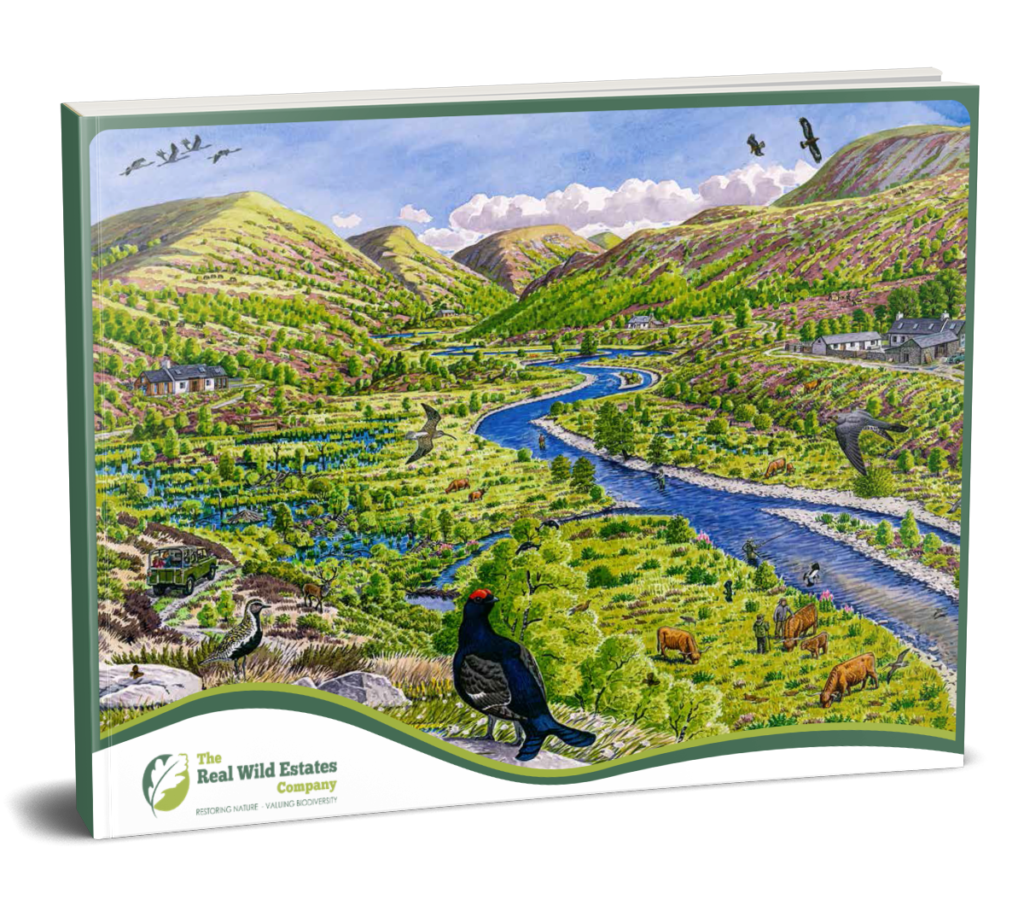

Balancing nature recovery with business viability ensures returns for nature and for you.

Download our brochure to learn more about our services

Please complete all the details below. Your data is subject to our Privacy policy here.

"*" indicates required fields